Qualitative Research Unearths the Need for Accessible Tax Education

Filing taxes isn’t just about paperwork —it’s about clarity, confidence, and tax education. The more financial service brands simplify tax education and demystify the tax journey, the easier it is for taxpayers to make informed decisions about their money, and the more accessible financial security becomes.

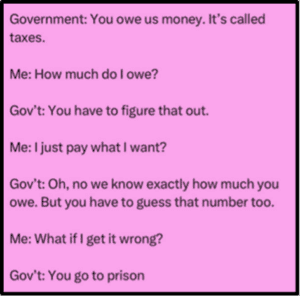

As a seasoned filer who has successfully navigated the process year after year—and collected a few nice refunds along the way—I still tense up when it’s time to sit down and prepare my taxes. I have seen this meme pop up more than once on my Instagram feed. I am not sure where it originated but it makes me laugh every time I see it or a variation of it.

Clearly, I’m not alone in my tax-time jitters and craving tax education!

Check out our white paper for the full story!

At KNow Research, we’re as ready as we can be for tax season. We recently explored tax attitudes through our 2024 pro bono project for Prepare + Prosper (P+P), a Minnesota-based nonprofit that helps lower-income and middle-income families by providing free tax preparation services, and a study we advised on in partnership with the University of San Francisco (USF) on how Gen Z and Millennials approach tax planning and tax education. While these cohorts may differ in their backgrounds, financial priorities and available resources, the studies reveal 4 commonalities about the tax journey and tax education needs.

1. A Shared Sense of Uncertainty

Both of the cohorts expressed a lack of confidence when navigating tax complexities. For instance, in the P+P study, many families shared they were unfamiliar with the new Minnesota Child Tax Credit (MN CTC) and unsure of their eligibility or how the credit works, while younger tax filers in the USF study questioned whether they were claiming all available deductions. The takeaway? People want to make the most of their returns—but often aren’t sure how and lack critical tax education.

2. Need for Trusted Guidance

Trust plays a critical role in tax filing. P+P clients lean on community-based, in-person resources like Prepare + Prosper to simplify their options and reassure them they’re making the right choices. Gen Z and Millennials, despite being digital natives, also crave human guidance and reassurance. They may hesitate to file completely on their own, without any oversight, due to fear of making costly mistakes.

Are you surprised that they still want human help? Check out our white paper for the full story!

3. Tax Education Needs

Taxpayers—regardless of income or age—need clearer, more accessible tax education, like:

- Simple, jargon-free explanations – Many people don’t know where to start, and dense tax language only adds to the confusion. Clear, plain-language explanations make it easier for taxpayers to understand their options and feel in control.

- Multiple formats for learning – Taxpayers absorb information in different ways. While some prefer step-by-step guides or explainer videos, others benefit from conversations with a trusted expert—whether that’s a tax professional, a nonprofit, or even a family member.

- Guidance tailored to real-life scenarios – The decision-making process isn’t one-size-fits-all. For families weighing lump sum vs. advance payments with the MN CTC, or young filers wondering about DIY software vs. professional help, having clear examples that apply to their situations can boost confidence.

- Reinforcement that they deserve their refunds – Many eligible filers, particularly lower-income families, hesitate to claim credits they’re entitled to because they question if they truly qualify. Messaging that reassures them—“This is your money. You earned it.”—can go a long way in encouraging action.

- Crave trustworthy messengers – Whether it’s a nonprofit like Prepare + Prosper, the local library, a university, a tax professional, a trusted website, or even content from a financial influencer on social media, tax education is most effective when it comes from a source that people trust.

4. Motivation: The Light at the End of the Tax Tunnel

Despite the challenges, the end goal remains the same: a financial boost. For P+P participants, refunds can serve as a lifeline, used to cover bills, pay for summer camps or sports for their kids, or help with essential expenses. For younger filers, a refund may mean paying down student loan debt or saving toward future goals. Regardless of demographic, taxpayers see filing as a means to financial security and opportunity—if they can just get through the process.

Want to better understand how people think about money, taxes, and financial decision-making?

At KNow Research, we uncover the real stories behind the numbers—helping financial brands, nonprofits, and policymakers bridge knowledge gaps and connect with the people they serve. Let’s work together to bring clarity, confidence, and empowerment to financial decision-making.

Contact us to learn more: admin@knowresearch.com and stay tuned for more from our USF partnership projects throughout 2025!